The probate process can be fast or it can be really slow all depending on the situation. If the previous owner has been deceased for two or more years, the whole procedure can take just as little as a week to complete. If the owner has passed away recently, and you want to sell the house, the probate process could take as long as 6 months since the records of the owner will need to be fixed first.

During the probate process, everyone involved can become stressed, anxious, and impatient. Most want to know how long the process will take, and many don't realize that it isn't quick. The entire probate process from opening the estate to closing could take anywhere between 6 to 12 months and sometimes even longer.

Probate allows the real property to be distributed to beneficiaries after a loved one's death. It's important that the process is done properly according to each state's statutes. Otherwise, there may be a question to an heir's right to take ownership or sell the property.

Losing loved ones comes with tremendous grief and sadness. This can prove to be too much for someone who have just gone through the process of losing a loved one.

Probate Process: In Summary

1. Will of the decedent is found and verified to be legal.

Most states have specific laws requiring anyone in possession of a will to file it as soon as possible. In the state of Florida, a will must be filed with the local circuit court within 10 days of learning about the death. The petition form and process may vary from state to state. In Florida, there is an option to accelerate the probate process with a Summary Administration if the estate is worth less than $75,000 or if the decedent has been deceased for more than two years. Otherwise, a formal administration petition is filed.

There are four main requirements to create a valid will: The will must have been executed with "testamentary intent," meaning that the person signing the will is of sound mind and memory, under no duress, and free of fraud. The signer of the will must also have the capacity to know and understand the nature of making the will, know the nature and extent of his or her property, and what it means to leave it to someone. The will must be signed and dated. Most courts take a liberal interpretation of what constitutes a signature. This could range from a nickname to even an "X" by an illiterate person. Witnesses must be present at the signing of the will, and it must also be signed by the witnesses.

Not all states require a will to be notarized to make it valid and legal. However, you can make your will "self-proving" if you and your witnesses go to a notary and sign an affidavit proving each person's identity and acknowledgment of the will. This can be done at the time the will is signed or later. Self-proving affidavits will help speed up the probate process since the court can accept the will without contacting the witnesses who signed it.

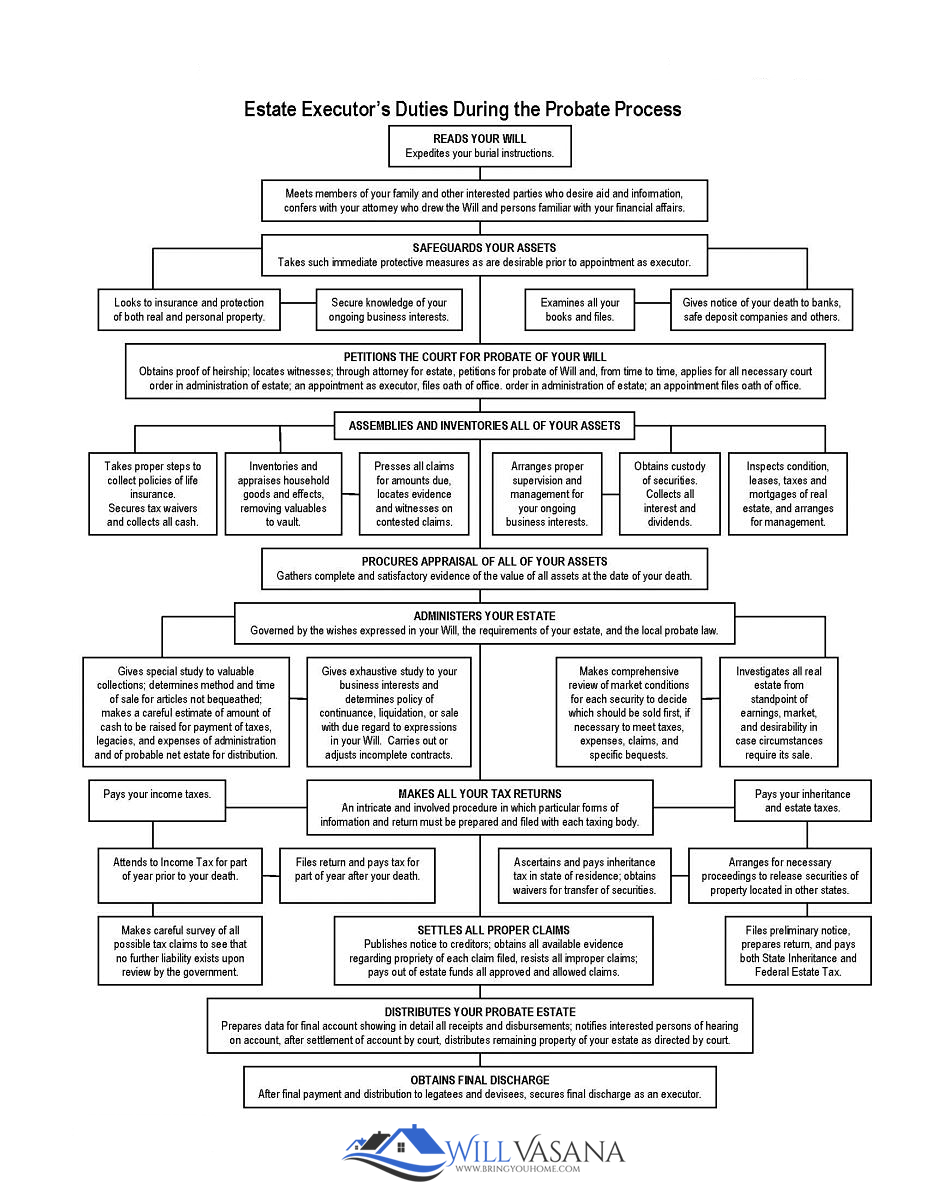

2. An executor or personal representative is appointed.

In most cases, a personal representative will be named in the will to carry out the execution of the will on behalf of the decedent. This person is sometimes referred to as the executor or administrator of the will. If there is no one named in the will as personal representative, the court will appoint one.

The following documents (some of which may not apply in every situation) will be signed by the Personal Representative and notarized in the state of Florida:

3. Probate bonds are posted.

This is a type of court bond that ensures an appointed representative will appropriately fulfill their duties by complying with state laws, and the terms of the will, trust or court order.

If you are appointed as the personal representative, your county court may require the bond to guarantee that all the estate debts will be satisfied and that the remaining assets will be properly distributed to the appropriate heirs.

Different types of probate bonds include:

The cost of a bond is usually based on the total amount of the estate that is to be managed by the representative.

Many wills drafted by an attorney will waive the requirement of the bond. Sometimes, the heirs of the will may agree to waive the bond, but if not, a probate bond is needed. All these bonds essentially act as a surety bond to protect the estate and the family of the deceased from any fraudulent or illegal actions on the part of the personal representative.

4. Receive Letters of Administration from court.

An estate checking or brokerage account is set up by either an attorney of the personal representative. An Employer Identification Number (EIN) may need to be obtained from the Internal Revenue Service. A copy of the Death Certificate, the EIN, and a certified copy of the Letters of Administration are taken to a bank to open an Estate account.

Once the Letters of Administration are received, the personal representative may put any real property on the market for sale. However, closing on the property must take place after the expiration of the creditor period.

5. Assets are located and protected.

Once the personal representative of the decedent is appointed, the first and often most difficult task is to take stock of all the decedent's assets in order to protect them.

This process usually requires combing through insurance policies, tax returns, and other documentation left behind. Sometimes an asset may not be named in the will, so this step can take a good amount of detective work.

When it comes to real property, the personal representative is charged with ensuring the property taxes are paid, insurance policies don't lapse, the property is secured against break-ins if vacant, and mortgage payments or association fees are paid so that the property doesn't go into foreclosure. The personal representative is not expected to take literal possession of the property during the probate process.

All bank accounts, investment portfolios, collectibles, vehicles, and other assets must be placed in exclusive control of the personal representative and protected. Insurance on all assets is verified with existing insurance companies (car, home, etc.)

6. Assets are appraised.

Once all the assets have been accounted for, many states require the personal representative to submit a written report listing everything along with its appraised value, noting how the value was calculated. The inventory of assets is filed with the Probate Court and depending on your state's statute, a copy may be required for the Department of Revenue.

In some states, the appraiser is court-approved while in others, the representative may choose someone.

7. Publish notice to creditors.

The decedent's creditors must be identified and notified publicly of the death. Most states still require this notice to be published in a local newspaper to alert creditors that may be unknown.

Creditors are given a limited time period after receiving the notice to make their claims against the estate. This time period can vary from state to state. In Florida, it's 90 days whereas in California is 60 days.

The personal representative has the ability to reject claims believed to be unfounded. However, creditors also have the right to petition the court to allow the judge to decide the veracity of the claim.

8. The decedent's debts are paid off.

The personal representative is also responsible for liquidating and closing the accounts owned in the decedent's name alone. All of the proceeds should be placed in the Estate account.

When the creditor period expires, documents proving that those with valid claims were paid will be filed with the Probate Court.

If there was real property waiting to be sold, a closing may occur at this time if it hasn't been bequeathed to a living beneficiary. A Petition to Determine Homestead Status of Real Property is prepared as well.

9. Tax returns are prepared and filed.

The personal representative must also file the decedent's last personal income tax returns for the year in which they died. It will be determined at that time whether the estate is subject to any estate taxes, and if applicable, those tax returns are filed as well. A Certified Public Accountant may be required to help navigate the complexities.

Any taxes due will be paid from the Estate account.

10. Remaining assets are distributed according to the will.

After all these steps have been done, the remaining assets are distributed to beneficiaries. Personal property, vehicles, heirlooms, and specific gifts under the will are usually the first to be distributed.

Generally, a Proposed Plan of Distribution is created as dictated by the decedent's will that beneficiaries will agree on before assets are distributed.

What happens if the personal representative of an estate doesn't follow probate proceedings?

A willful refusal to file the will may result in a court finding the person in possession of the original will in contempt of court. If you are an heir of an estate and potential beneficiary of a will, you can initiate a probate proceeding by filing a petition for administration with the circuit court in the county where the decedent resided at their time of death.

It's possible that someone could challenge the appointment of a representative who fails to act in a timely manner. If a court finds the representative has been derelict in his or her duties and a new representative may be appointed.

If the executor or personal representative fails to timely administer the estate, any beneficiary of the will or creditors of the estate may have a legal cause of action against the personal representative. There are also potential repercussions from local, state, and federal governments if taxes are filed properly.

Remember the probate bond? A claim can be filed against your bond if someone believes you aren't complying with the terms of the will, trust, or court order. Anyone can make a claim against the bond. The surety company that issued the bond will expect a representative to take care of the claim. If the claim goes unsettled, the surety company will investigate to determine the claim's validity. If it's found to be valid, the representative will be expected to compensate the claimant for financial loss or damages. The surety company may pay out the claim in some cases, but they will expect reimbursement for the settlement and legal costs incurred.

In Florida, there are three types of probate administration:

1. Disposition of Personal Property without Administration.Disposition of Property without Administration or Small Estates Proceeding

Under Section 735.301 of the Florida Statutes, no administration or formal proceedings are required when the only property you leave behind are exempt personal property under Section 732.402 and the Florida Constitution.

Criteria: nonexempt personal property value not exceeding the amount required for funeral expenses and reasonable and necessary medical bills in the last 60 days of your passing. In Duval County, for example, you can start a Disposition of Personal Property without Administration procedure if the estate consists only of cash assets, a vehicale or other personal assets with a total value of $6,000 or less, and you paid the funeral bills for your relative. This procedure may only be done in the county of the decedent's permanent residence as of the date of death.

It is recommended that you seek advice of a probate attorney and the Clerk of Courts in your particular county who can assist you with this process.

Summary Administration is available when your assets are less than $75,000 or your death occurred over 2 years ago.

Although summary administration can be administered a lot quicker than formal administration, probate attorneys do not like to do summary administration in a lot of instances, specially if the decedent has been dead for less than two years.

The reason for this is that after two years the claims of any creditors of the decedent are barred. In summary administration, if the person has less than $75,000 in assets but has been dead for less than 2 years, it is recommended for the probate attorney to do a notice of creditors, which at this point the time frame becomes more of a formal administration without the added notice requirements. As a caveat, if you will be selling the real estate of the decedent through the probate process, you will need to do it through the formal administration process.

In summary administration, no personal representative is appointed. The petitioner, most likely a surviving spouse or a family member, will file a Petition for Summary Administration and provide the Probate court with all the other required documents, like the Last Will and Testament, a Death Certificate, and any other document pertinent to the administration.

Once the probate judge reviews the documents, and he/she is satisfied that all the requirements are met, and that the estate has no creditors, and/or the assets of the estate are exempt, the probate judge then will sign an order approving of the administration and the transfers of assets. This process can take anywhere between 1-3 months depending on the complexity, number of assets, beneficiaries, and the county where the estate is being probated.

The traditional Florida probate process - known as formal administration - is necessary when the assets of an estate are valued at more than $75,000 and the decedent has been dead for less than two years.

Summary administration is a "shortened" form of Florida probate that is available if the assets of an estate are valued at $75,000 or less or if more than two years have passed since the decedent's death. However, it is important to note that the value of a homestead property is not taken into account in the $75,000 threshold, which means it is possible to bring a homestead property through the Florida summary administration process even if its value exceeds $75,000.

Summary administration of homestead property is virtually identical to formal administration of homestead property. If the only asset that requires Florida probate is a homestead property, summary administration is a very suitable choice.

If an asset that requires probate is not homestead property and summary administration is available, note that most judges in Florida will not transfer the property until the 90-day creditor period has ended.

If you would like a referral to Duval County, Clay County, St. Johns County, Nassau County, Putnam County for a probate and estate planning attorney, our team would be glad to provide recommendations. We understand the rules of engagement with the Probate Court and collaborate with the probate attorneys to ensure a smooth transaction. We offer full service and manage all the details and meet your specific needs pertaining to the sale of the estate, conservatorship or trust's real property. Our service extends beyond real estate. Our current and past customers appreciate our knowledge, experience, and our compassion and understanding of the duties of the Personal Representative.

Formal Administration is typically required when the assets are over $75,000 and you have been dead for less than 2 years. Formal administration is typically also required even if you have been dead for over 2 years if real estate is going to be sold during the probate process. The reason why the 2 year mark is so important is because after 2 years your creditors will be barred from bringing any claims under your estate, subject to some exceptions.

Formal Administration is begun when a Petition for Formal Administration is introduced to the Probate Court in the county where you resided or the county where the real estate is located.

The Petition for Formal Administration is introduced by the petition with the assistance of a probate attorney. When there is the Last Will and Testament, the Will will typically outline your preference as to the appointment of a personal representative.

If there is no Last Will and Testament (Intestacy Proceedings), Florida law gives preference to your surviving spouse, then to the person selected by the majority of your beneficiaries, and then to your heir nearest in degree.

As with any type of probate administration, your Last Will and Testament must be introduced, if any, and a Certified Copy of your Death Certificate.

Formal Notice of the Petition for Administration must be given to all interested parties or they must waive service of the Formal Notice.

Once the requisite period of the Formal Notice has passed (20 days) or all the waivers from the beneficiaries have been obtained, a probate judge will sign the Letters of Administration, and an Order Admitting the Last Will and Testament, and appointing the Personal Representative.

These orders are what give the personal representative the powers to act on the behalf of the estate and do all the duties that are required.

Once a personal representative is appointed, the next step is to publish a Notice of Creditors in a local newspaper in the county where you resided. You must service notice to any known creditors and they will have 30 days to bring a claim from the date of service. Any unknown creditors will have 3 months from the date of first publication to bring in a claim.

If you were 55 years or older at the time of your death, then the Notice of Creditors must all be served to the Agency for Health Care Administration ("AHCA.") AHCA is responsible for administering the State of Florida Medicaid Program. If you were receiving Medicaid benefits at the time of your death, then AHCA may bring in a claim for any money paid on your behalf for medical services.

During the Creditor claim period, the personal representative with the assistance of the probate attorney must prepare an inventory of all your assets being probated. The inventory is due 2 months from the signing of the Letters of Administration.

If any claims are filed, the personal representative may either object to the claim, strike the claim as untimely, or accept responsibility. The personal representative will have 30 days from the filing of the claim to object to any claims brought by a creditor. If any claim is objected to, then the creditor will have 30 days to file an independent action to satisfy their claim.

One possibility could be that although there are creditor claims, all the assets under your estate may be exempt from the reach of creditors. This is typically the case with exempt Homestead and other exempt personal property.

One trap for the unwary is when you require your Homestead to be sold during the probate administration and the proceeds distributed to your beneficiaries. This will result in the loss of the Homestead protection and the proceeds accessible to any creditors of the estate which you did not object too.

If the creditors claims were not properly objected to by the personal representative, then the personal representative with the assistance of the probate attorney must petition the Probate court to pay the creditors out of the nonexempt assets of the decedent.

Once the creditor claims are satisfied, then the probate attorney can petition the probate court to distribute the assets of the estate to your beneficiaries according to their allocated interest. The probate attorney will get consent from the beneficiaries and proof of receipts.

Depending on your engagement with your probate attorney, here is typically where the probate attorney will collect his or her fees out of the probate assets being distributed.

In the distribution phase, we also file a Petition Determining Homestead (if not done earlier) and/or an Order Determining Homestead Status of Real Property. Although the Florida Homestead is not a probate asset, most probate judges will not sign an order determining Homestead until all the creditors are ascertained at the end of the creditor period.

Finally, the personal representative with the probate attorney's assistance need to file an accounting of the estate. The accounting is particularly important when there are unpaid creditors but there are not sufficient assets to satisfy those creditors.

At this point, you should have done most if not all the necessary things to administer the estate.

The final thing to do is to petition the court to discharge the personal representative. In order to discharge the personal representative, the probate court must find that 1) the estate has been fully administered and property distributed; 2) claims of creditors have been paid or otherwise disposed of; 3) the taxes imposed by Chapter 198, if any, have been paid; and that 4) the Personal Representative should be discharged.

Once the personal representative has been discharged then he or she is relieved of any further duties or liabilities and the estate is closed.

If at the end of the formal administration there are any unpaid creditors, then if any assets are later found, then those creditors may attach to those assets assuming they are not exempt.

Disclaimer: I hope you find this information useful. This does not cover every aspect and practice that goes on in Florida probate court, but it provides insight on how the probate process works and what to expect.