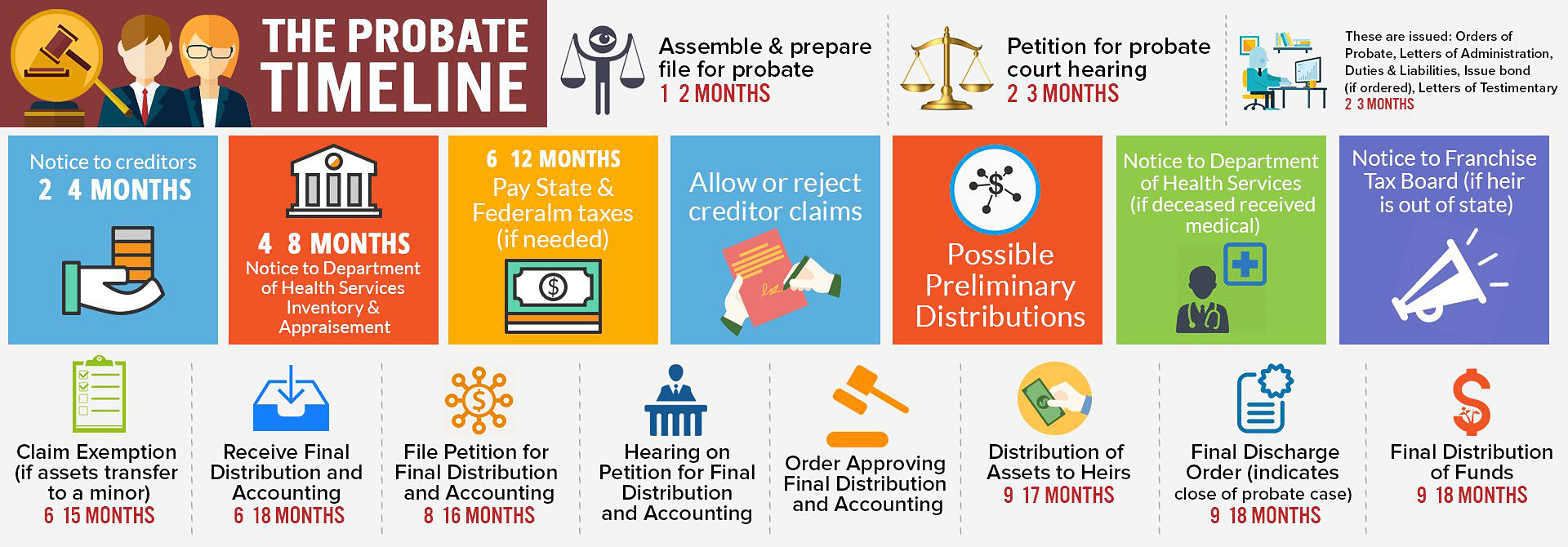

The following outlines the steps involved in the probate process. No two probate cases are the same. Every probate case is unique as an individual's fingerprint. There is no such thing as typical probate. This will help you determine how long the probate process may take and give you a clearer understanding of the process.

The probate timeline will vary depending on many factors.

| Activity | Timeframe |

| Prepare and File Petition for Probate | 1-2 months |

| A court hearing on the Petition for Probate | 2-3 months |

| Orders for Probate & Letters Testamentary or Letters of Administration get issued by the Court. A bond gets issued, if ordered | 2-4 months (if not contested) |

| Notice to Creditors filed | 2-4 months |

| Notice to Department of Health Services Inventory & Appraisal | 4-8 months |

| State and Federal Taxes get paid if necessary | 6-12 months |

| Reject or Allow Claims of Creditors | 6-12 months |

| Preliminary Distributions from Estate | 6-12 months |

| Notice to Department of Health Services (if deceased received medical) | 6-12 months |

| Notice to Franchise Tax Board (if an heir is out of state) | 6-12 months |

| A claim of Exemption (if assets transfer to a minor) | 6-15 months |

| Receive Final Tax Letter from State and Federal if appropriate | 6-18 months |

| File Petition for Final Distribution and Accounting | 8-16 months |

| Hearing on Petition for Final Distribution and Accounting | 8-16 months |

| Order Approving Final Distribution and Accounting | 8-16 months |

| Distribution of Assets to Beneficiaries and Heirs | 9-17 months |

| Final Discharge Order (shows close of probate case) | 9-18 months |

| Final Distribution of Funds | 9-18 months |